What are FHR (Fixed Deposit Home Rate), FHR18(Fixed Deposit Home Rate 18) & 36 FDMR(36-month Fixed Deposit Mortgage Rate)?

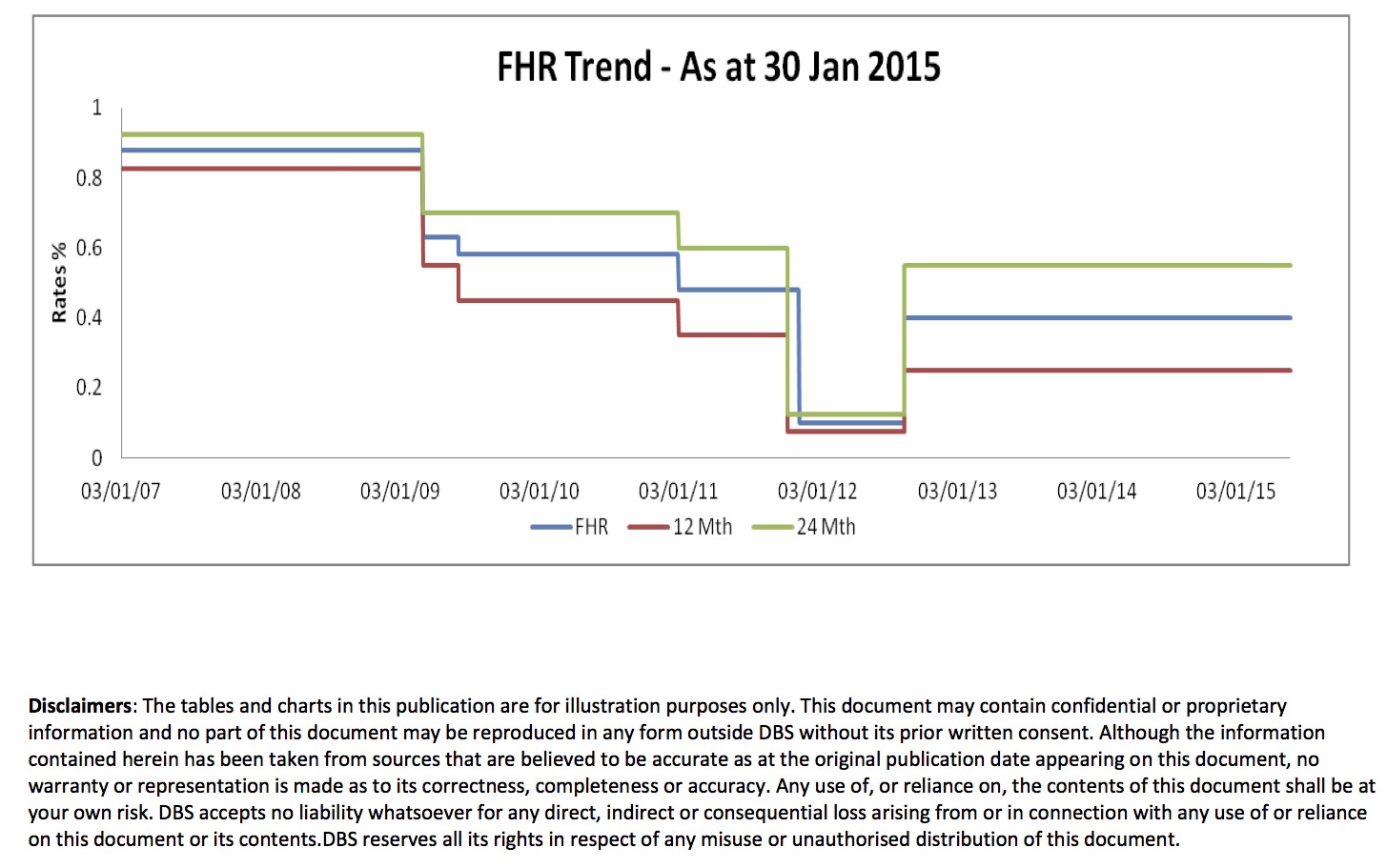

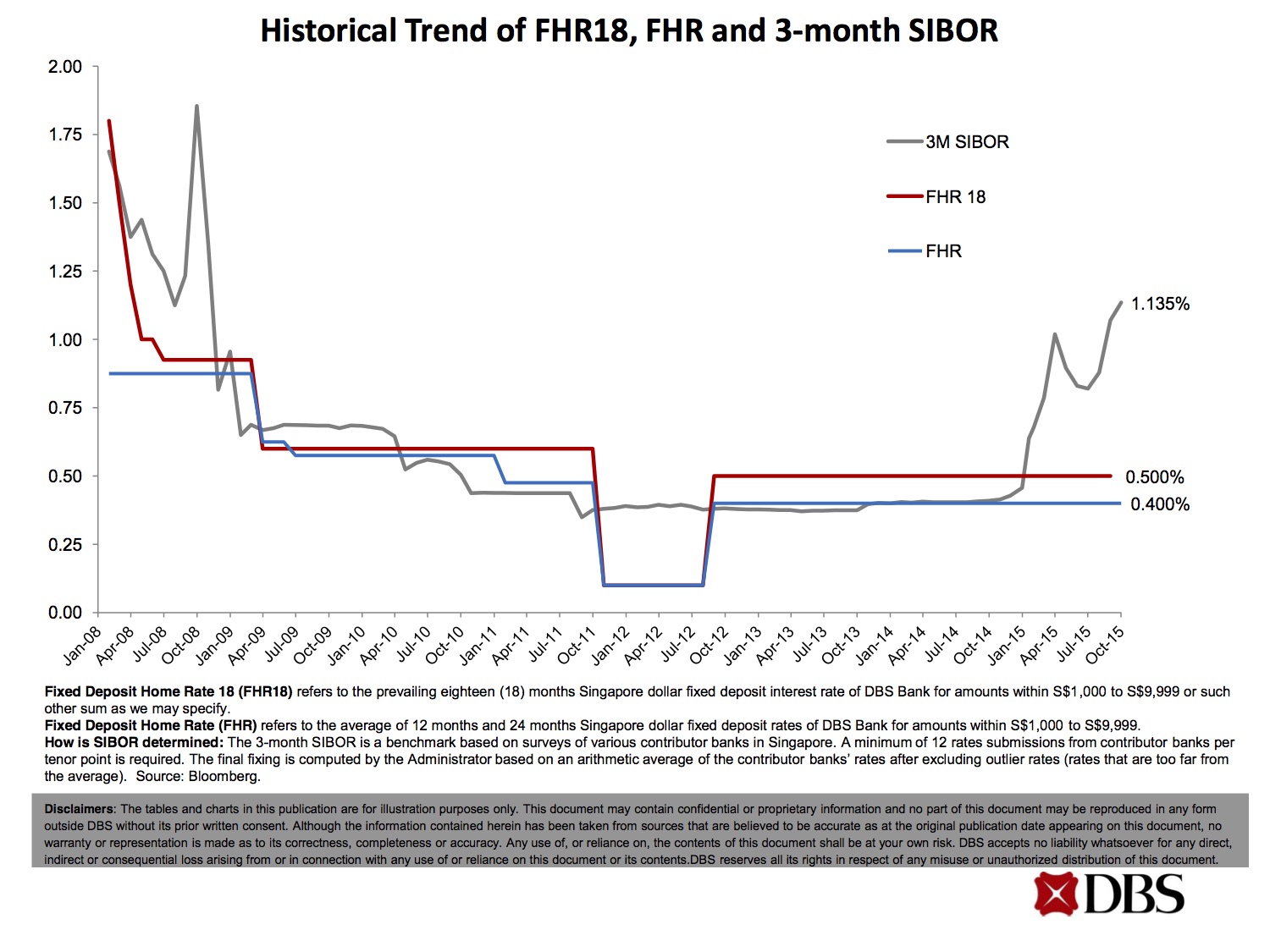

Both FHR & FHR 18 are offered by DBS. FHR (Fixed Deposit Home Rate) is calculated based on the average between the prevailing twelve (12) months and twenty four (24) months Singapore Dollar Fixed Deposit interest rate for amounts within S$1,000 to S$9,999 or such other sum as the bank may specify. The current FHR is 0.675% per annum. This benchmark was introduced in early 2015 and replaced by FHR18 in the later part of 2015.

FHR18 (Fixed Deposit Home Rate 18) is calculated based on the prevailing eighteen (18) months Singapore dollar fixed deposit interest rate of DBS Bank for amounts within $1,000 to $9,999 or such other sum as the bank may specify. The current FHR18 is 0.6% per annum. Please refer to their website for their latest updatehttp://www.dbs.com.sg/personal/rates-online/singapore-dollar-fixed-deposits.page

36FDMR (36-month Fixed Deposit Mortgage Rate) is pegged to OCBC’s 36-month SGD Fixed Deposit rate for amounts between $5,000 and $20,000. The 36-month SGD Fixed Deposit Rate (0.65% per annum currently) may be found on OCBC’s website at http://www.ocbc.com/personal-banking/Accounts/sgd-fixed-deposit-interest-rates.html

How do these benchmarks work?

In nature the 3 benchmarks are similar:

They are all pegged to the bank’s own fixed deposit rate and are actual deposit interest that banks need to pay for money collected from individual depositors and it is in the bank’s interest not to increase the bank’s cost of funds.

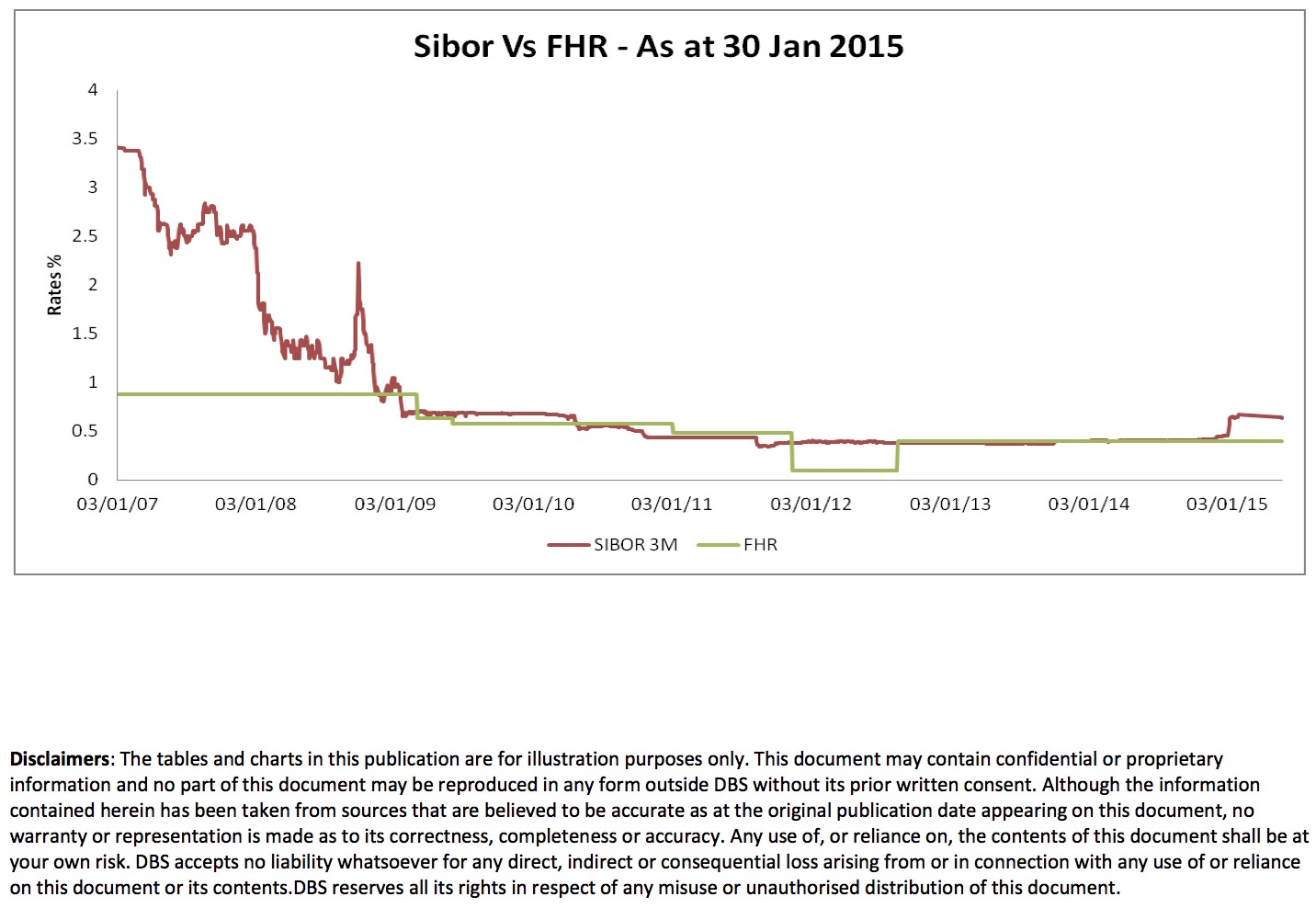

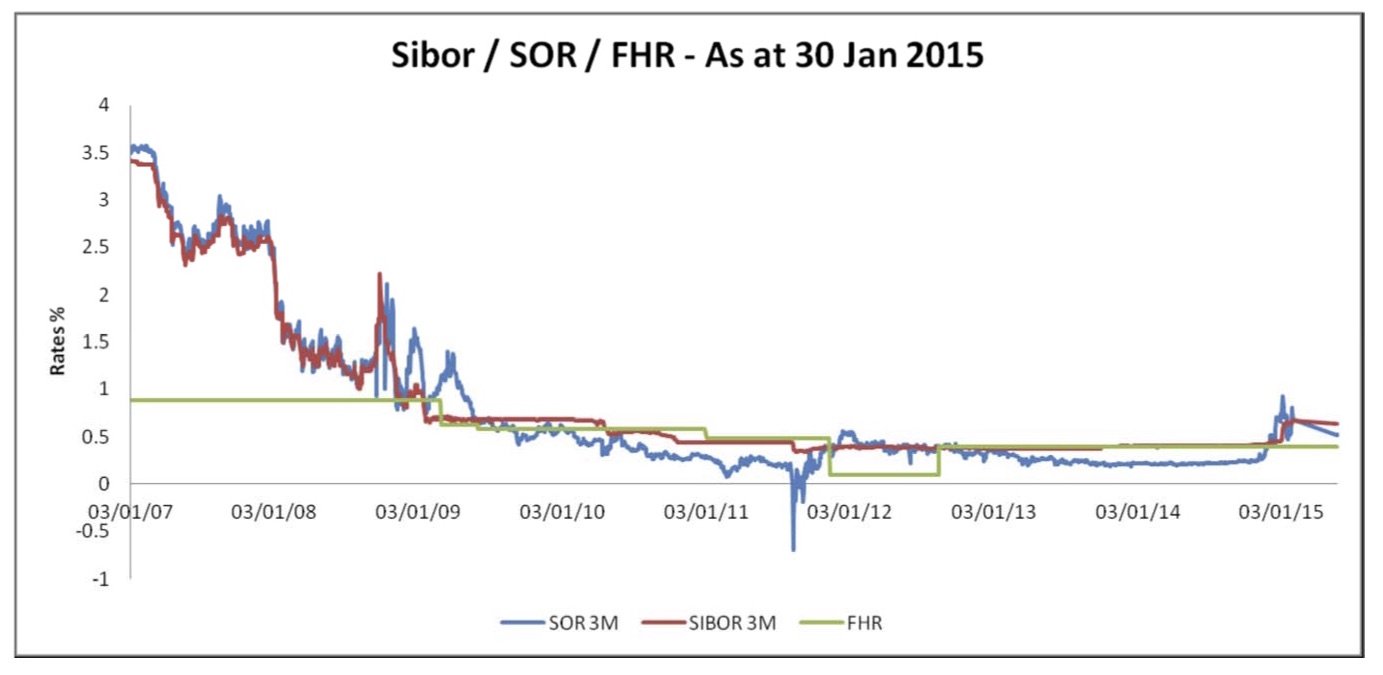

However the benchmarks are still affected by SIBOR which in turn is affected by the US Fed Reserve Rate. This explains why DBS increased both FHR & FHR18 around Christmas 2015.

The benchmarks are transparent as the rates are published on the bank’s respective websites.

Why choose FHR/FHR18/36FDMR pegged packages?

Those packages are popular since they were launched in 2015 as they won’t increase as fast and high as SIBOR/SOR as the banks have to take the costs of funds from their depositors into account.

Similar to SIBOR/SOR packages, banks add a loading/spread on top of FHR/FHR18/36FDMR. Banks decide how much to load for each year ranging from 0.8% – 1.58% which is normally guaranteed, and FHR/FHR18/36FDMR will be the factor causing total effective rate to rise or fall.